Are you looking for an online real estate company that makes investing in real estate simple, efficient, and transparent and lets average investors buy into private commercial and residential properties by pooling their assets through an investment platform? Look no further! Fundrise is a real estate investing platform that makes it easy to invest in a low-cost, diversified portfolio of institutional-quality real estate starting at only $10.

Fundrise promotion is currently offering a $10 sign-up bonus to new users when they make an initial deposit of a minimum of $10 within 30 days of account opening. Plus, Users can earn up to a $100 Fundrise referral bonus to invite friends Fundrise platform.

So stay with us; In this article, we’ll tell you what exactly Fundrise is, about Fundrise promotion, its features, whether it is legit or not, and much more. Let’s get started-

Before you get to know more about Fundrise Promotion, read our another article on similar real estate investing platform Groundfloor Promotion.

What is Fundrise?

Fundrise is an online real estate investing platform that allows average investors to participate in real estate investments through crowdfunding. Fundrise offers a variety of products, including real estate investment trusts (REITs), eFunds, and a Flagship Fund. By pooling investments, Fundrise enables people to invest in real estate projects and diversify their portfolios.

Recently, Fundrise has also launched an Innovation Fund, which focuses on privately held tech companies. With Fundrise, you can invest in professionally managed residential real estate (eFunds) or a diversified portfolio of commercial real estate (eREITs).

Fundrise Promotion 2023

Here are the current best Fundrise promotion running on the platform for new users:

- Fundrise $10 Sign-Up Bonus

- Fundrise $25 to $100 Referral Bonus

Fundrise $10 Sign-Up Bonus

Fundrise is offering a $10 sign-up bonus to new investors when you register for a new Groundfloor investor account using this referral link and deposit a minimum of $10 into your account to qualify.

How to Claim a $10 Sign-Up Bonus

- Visit the Fundrise website or download the app.

- Create a free account with this Fundrise referral link.

- Make an initial deposit of $10 for a Starter level account or more for a Basic account.

- As soon as your $10 deposit settles in your Fundrise account, you will receive $10 in bonus shares of real estate in your portfolio.

- You will receive $10 bonus shares within approximately one week after you have met all the conditions.

Fundrise Up to $100 Referral Bonus

Moreover, Fundrise is offering its active users up to $100 in referral bonuses for making successful referrals. For each friend who successfully joins Fundrise through your invitation, you can earn up to $100 in bonus shares (depending on your account level). If they join as well, you will receive a bonus share as well.

Steps To Claim up to $100 Referral Bonus

- Login to your Fundrise account.

- Go to the “Invite-a-Friend” section to access your unique referral link.

- Send your referral link to family and friends.

- You’ll receive up to a $100 referral bonus when your referrals register with Fundrise via your unique referral link and deposit at least $10 into their new account.

Important Note-The referral bonus offered by Fundrise depends on what type of account you open. If you open a basic account, you will receive a $50 bonus for each successful referral. For those with a Premium account, both the referrer and referee will receive a $100 bonus, regardless of the amount deposited by the referee. Click here to read full terms and condition

Fundrise Features

Here are some of the main features of Fundrise –

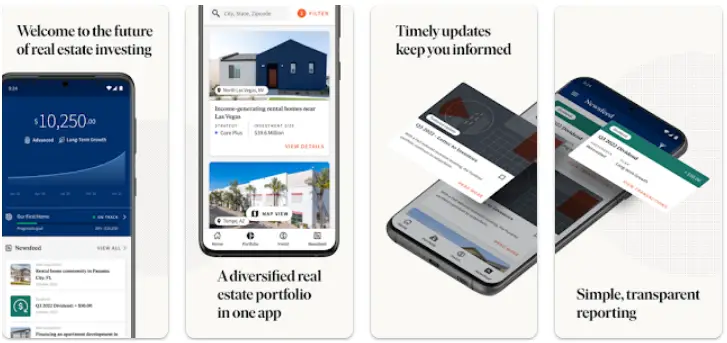

- Easy to use– The Fundrise app is easy and simple to use.

- Flexible investment minimums- Fundrise low investment minimum gives you the flexibility to invest the right amount of money for you, on your schedule, to meet your financial goals, unlike most private real estate investments.

- Maximize returns with our low-fee approach- Fundrise’s advanced technology and unique low-fee model are designed to ensure you keep more of what you earn. It gives you maximum returns with our low-fee approach.

- Next-level diversification- Fundrise has next-level diversification that is critical to long-term wealth creation and preservation. They make it easy to diversify beyond stocks and bonds, outside the stock market. Fundrise diversification helps you minimize asset correlation and portfolio risk as your investment portfolio gains immediate exposure to dozens of high-quality private market assets.

- Bank-level security-Fundrise uses bank-level security for your protection. Investor information is encrypted with bank-level AES encryption. Two-factor authentication is available to all investors, and App users have access to the added layer of protection available through Touch ID and Face ID access.

- Transparency- The Fundrise platform has a great deal of transparency. Within minutes of investing, you can watch as your dollars are diversified. Through your investor newsfeed, you can watch as each asset in your investment portfolio progresses, including developments such as new construction updates, occupancy reports, market data trends, and project completions.

Fundrise fees

Fundrise charges an annual asset management fee of 0.85%, an advisory fee of 0.15%, and in some cases, a development or liquidation fee. This adds up to a total of 1-2% annually. However, the majority of investors will only be charged 1% annually. There are no sales commissions or transaction fees with Fundrise.

Pros & Cons

Pros

- Small upfront capital is required.

- Accessible to all investors.

- User-friendly platform.

- Individual Retirement Account (IRA) accounts are available.

Cons

- Lack of liquidity.

- Potentially complicated fee structure.

- An investor must perform their own due diligence.

Is Fundrise Legit?

Yes, Fundrise is a legitimate real estate investment platform that is registered as an Investment Advisor under the Investment Advisers Act of 1940 with the Securities and Exchange Commission. The company is an SEC-registered investment advisor and is regulated by the Financial Industry Regulatory Authority (FINRA).

Is Fundrise Safe?

Yes, Fundrise is safe for investors. Fundrise is a legitimate real estate investment platform that is SEC-registered and fully compliant with all applicable securities regulations. The company also employs high levels of security and encryption to protect the data and funds of its customers. Additionally, Fundrise is a member of the Financial Industry Regulatory Authority (FINRA) and is regulated by the SEC and state securities regulators.

Who is Fundrise best for?

Fundrise is best for investors with a long-term outlook who are seeking diversification outside of stocks and bonds and are willing to do their own due diligence would be the ideal investors.

Conclusion

Overall, Fundrise is a simple and efficient online real estate company that allows average investors to participate in real estate investments through crowdfunding and only takes $10 to get started. Additionally, Fundrise promotion offers a $10 sign-up bonus and up to a $100 referral bonus to its users. So in my opinion it is an excellent app with so many features and you should give it a try.

FAQ

What is the Fundrise referral bonus?

Fundrise referral program offers up to a $100 bonus (depending on the account you use)when you invite your family and friends to join the platform.

Is Fundrise worth it

Yes, Fundrise is completely worth it and you can make money investing in Fundrise. In fact, over the past five years, Fundrise investors have seen real-time returns of over 60.4% since 2015. This is much higher than average market returns and is a great way to diversify your portfolio and earn passive income from real estate investments.

Is Fundrise profitable?

Yes, Fundrise has been profitable since its founding in 2012. The company has helped over 200,000 investors raise over $3 billion in the capital, and has experienced a 600% growth in revenue since 2017.

Can you make good money on Fundrise?

Yes, you can make good money on Fundrise. Fundrise has a track record of providing investors with consistent returns over time, with investors typically earning between 8-12% annually.