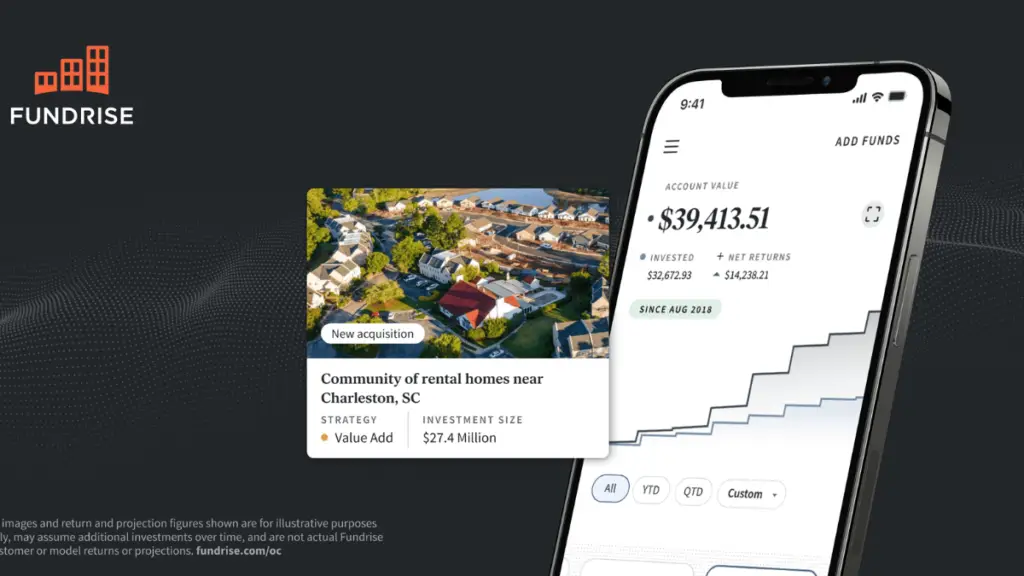

Fundrise is a popular real estate investment platform that allows individuals to invest in private real estate deals and investing in real estate through platforms like FundRise offers individuals a pathway to diversify their portfolios and potentially generate passive income.

Also with Fundrise promotions, you can get a $10 sign-up bonus as a new user when you make an initial deposit of a minimum of $10 within 30 days of account opening. Plus, you can earn up to a $100 Fundrise referral bonus to invite friends Fundrise platform.

However, when it comes to withdrawing funds from these investments, the process may not always be straightforward. So stay with us; In this article, we’ll delve into how to withdraw money from Fundrise, covering important considerations such as timing, fees, and procedures. Let’s get started-

Also don’t forget to check similar real estate investing platform Groundfloor Promotion to get a $50 Groundfloor sign-up bonus and a $50 Groundfloor referral bonus for inviting your friend to join Groundfloor

What is Fundrise?

Fundrise is a financial technology company based in Washington, D.C., established in 2010. It operates an online investment platform, pioneering the crowdfunding of investments in the real estate market.

Fundrise offers individuals access to institutional-quality alternative investments, including real estate, venture capital, and private credit. The platform provides a straightforward way for investors to diversify their portfolios and participate in private market opportunities typically reserved for larger institutional investors.

How to Withdraw Money from Fundrise?

Here’s how to withdraw money from Fundrise.

Steps to Request Redemption:

- Navigate to Account Settings: Log in to your Fundrise Investor dashboard and navigate to Settings → Account Settings.

- Submit Redemption Request: At the bottom of the Account Settings page, you’ll find a section named “Redeem Shares.” Click on the provided link to access the Redemption Request Form.

- Fill Out the Form: Complete the Redemption Request Form, specifying whether you wish to withdraw some or all of your shares. Submit the form to initiate the redemption process.

- Review Redemption Policy: Familiarize yourself with Fundrise’s redemption policy, available for review on their website at fundrise.com/oc. Understanding the terms and conditions will ensure a smooth redemption process.

Check the easiest way to make quick cash from the Temu app where you can get free stuff on Temu just by playing Temu games, and inviting friends to join Temu.

Considerations for Early Redemption

It’s important to note that early redemption may come with certain implications. While Fundrise aims to provide flexibility for investors, there may be fees or penalties associated with redeeming shares before the end of the investment term. Additionally, the timing of redemptions may be subject to quarterly schedules, so be sure to plan accordingly.

The Long-Term Approach

While early redemption is an option, it’s worth emphasizing Fundrise’s emphasis on long-term investing. The platform distributes dividends quarterly, providing investors with opportunities for passive income. By viewing Fundrise as a diversified long-term investment strategy, investors can maximize their potential returns while mitigating short-term fluctuations

Timing and Review Process

Fundrise operates a systematic review process for liquidation requests across its various investment products, including the Flagship Fund, Income Fund, Innovation Fund, eREITs, and eFunds. It’s important to note that timing plays a significant role in when your liquidation request will be processed.

- Quarterly Reviews: Liquidation requests for the Flagship Fund, Income Fund, and Innovation Fund are reviewed every quarter.

- 60-Day Waiting Period: For the Fundrise eFund, there is a 60-day waiting period before liquidation requests are processed.

- Submission Deadline: To ensure your request is reviewed within a specific quarter, it must be submitted by the last business day of that quarter.

Understanding Fees

When considering a liquidation request, investors should be aware of any associated fees. While the Flagship Fund, Income Fund, and Innovation Fund do not impose penalties for liquidation, certain eREIT and eFund shares may be subject to penalties if held for less than five years.

- Penalty Structure: Penalties incurred upon early liquidation are intended to defray costs for other shareholders and are paid back into the fund.

- First-In, First-Out (FIFO): Liquidations on Fundrise follow a “First in, first out” process, meaning shares held for the longest duration will be liquidated first.

Want to earn some extra money? Checkout CSl Plasma promotions to get a $100 sign-up bonus, along with a $50 CSL Plasma referral bonus and an extra CSL Plasma $700 Coupon. You can also checkout CSL Plasma Pay Chart to know more about payment details.

Limitations and Considerations

Despite efforts to process all liquidation requests, Fundrise highlights that certain limitations may apply. Investors are encouraged to review the relevant offering documents for each fund, available on the Fundrise website, for additional information and details.

Conclusion

In conclusion, navigating the process of withdrawing funds from Fundrise may seem daunting at first, but armed with the right knowledge, investors can confidently manage their investments.

By understanding Fundrise’s redemption process, considering the implications of early redemption, and embracing a long-term investment approach, investors can unlock the full potential of their real estate investments on the platform.

Frequently Asked Questions

What is the process for withdrawing funds to a bank account from Fundrise?

To withdraw funds from Fundrise, investors must first log in to their account and navigate to the “Withdraw” tab. From there, they can select the investment they wish to withdraw from and enter the amount they would like to withdraw. Next, they will be prompted to enter their bank account information and confirm the withdrawal request.

How long does the withdrawal process typically take with Fundrise?

According to Fundrise, the withdrawal process typically takes between 5 and 7 business days to complete. However, the exact timeline may vary depending on a variety of factors, including the amount being withdrawn and the investor’s bank processing times.

Are there any fees associated with withdrawing funds from Fundrise?

Fundrise does not charge any fees for withdrawing funds from an investment. However, investors should be aware that their bank may charge fees for receiving the transfer.